NEW DELHI: While, the country will steadily start facing the shortage of resources for livelihood of its over 1.3 billion people. The terms like Jal (water), Jangal (forest) and Jameen (land) are being frequently used by the political and other parties at several occasions. However, there seems no concreate actions plan laid out by the establishments. The slogan like this has been exposed time to time.

The SC bench also remarked that “freebies and the social welfare schemes are two different things and it needs to be balanced the country economic positions. The CJI Raman also urges to put something concreate suggestions before my retirement which is due on August 26, 2022“.

Ashwini Upadhyay, a distinguished lawyer of the Supreme Court has filed a PIL (public interest litigation) with regard to uncontrolled freebies announced by all political outfits during the election seasons.

The petitioner also said Election Commission has not been able to regulate the promises made by political parties in their manifestos despite the apex court’s direction in earlier judgements.

In a plea to the Apex Court, Upadhyay has urged the court to take stringent actions against those who promising freebies. In plea, he went on to urge the Election Commission (EC) to invoke its power to freeze and cancel party’s registration as well.

Though, the CJI says that “court doesn’t want to de-registering political parties, which will be unfair and undemocratic, however, he cautions on the freebies being promised without any rationality in its term.

The mandate of the Election Commission has not been obeyed, the written submission said, adding “No action has been taken by the Election Commission in this regard against any political party for violation of the Model Code of Conduct mentioned above.” It is also considering the distribution of freebies by the political parties from public funds and its adverse impact on the fiscal health of the country.

The petitioner has purposed seven members committee on freebies are as follows: Chief Election Commission, Chairman Finance Commission, Governor Reserve Bank of India, Controller & Auditor General of India, Chairman Law Commission, CEO NITI Aayog and Chairman of National Institute of Public Finance and Policy.

The bench, which has sought the views of stakeholders like the Centre, Niti Aayog and Finance Commission and asked them to brainstorm on the issue of freebies, had hinted it may order setting up a mechanism for suggesting measures to the government to deal with the issue.

In the backdrop

The written note quoted the ‘Handbook of Statistics of Indian States for 2020-2021’ published by the Reserve Bank of India, and the June 2022 bulletin of the federal bank in which an article under the heading ‘State Finances: A risk analysis in the backdrop of the Sri Lankan crisis and the heavy indebtedness of the States’ was published to buttress its claim against freebies”.

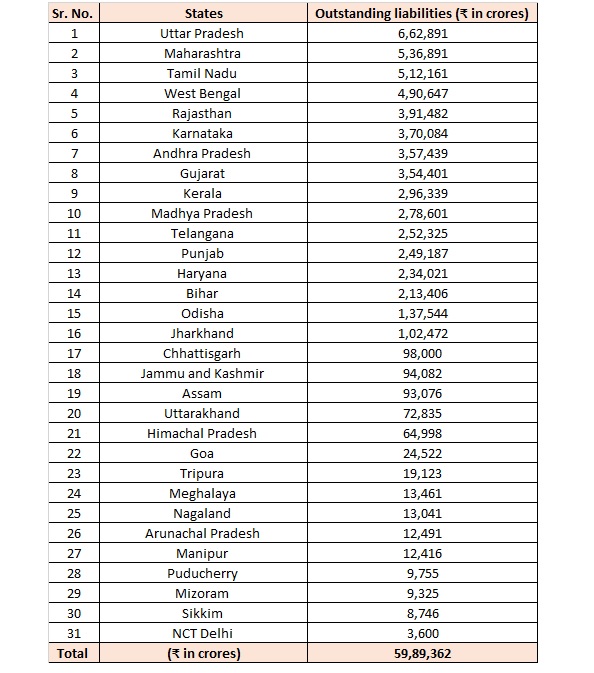

The states have outstanding liabilities of a whopping Rs 59,89,360 crore as on March 31, 2021 and the new sources of risk have emerged in the form of rising expenditure on non-merit freebies, the Supreme Court was told on Thursday by a PIL petitioner opposing irrational handouts.

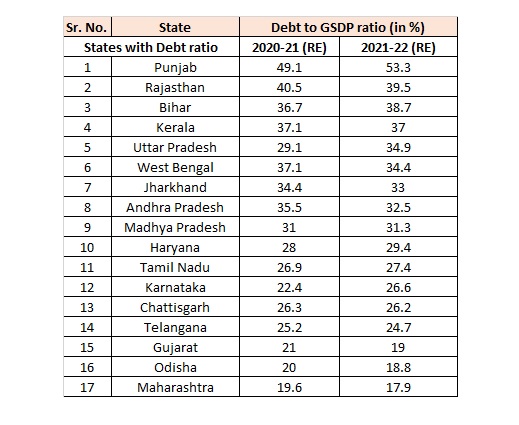

While Uttar Pradesh and Maharashtra top the chart with liabilities of Rs 6,62,891 crore and Rs 5,36,891 respectively, Punjab gets the distinction of being the leader in the debt to Gross State Domestic Product (GSDP) ratio.

Punjab, with a liability of Rs 2,49,187 crore, has the worst debt to GSDP ratio at 53:3 in the current fiscal, said the written submission filed by PIL petitioner Ashwini Upadhyay before a bench headed by Chief Justice N V Ramana.

Rajasthan, which has the total liability of Rs 3,91,482 crore, comes second to Punjab in the debt to GSDP ratio which is at 39:5 in the current fiscal.

State-wise breakup of outstanding liabilities is as under:

In June 2022, The Reserve Bank of India, has published an article under the heading ‘State Finances: A risk analysis’ in the light of the Sri Lankan crisis and the heavy indebtedness of the States. The article highlights, “new sources of risk have emerged in the form of rising expenditure on non-merit freebies, expanding contingent liabilities and the ballooning overdue of DISCOMS”.

“As per the latest available data from the Comptroller and Auditor General of India (CAG), the State governments’ expenditure on subsidies has grown at 12.9 percent and 11.2 per cent during 2020-21 and 2021-22, respectively, after contracting in 2019-20.…..Subsidies

The article published some statics that suggests, the debt: Gross State Domestic Product (GSDP) ratio of the States is as hereunder:

The recent economic crisis in neighbouring Sri Lanka is a reminder of the critical importance of public debt sustainability. The fiscal conditions among States in India are showing warning signs of building stress. ….For the five most indebted States, the debt stock is no longer sustainable, as the debt growth has outpaced their GSDP growth in the last five years.

New sources of risks have emerged – relaunch of the old pension scheme by some States; rising expenditure on non-merit freebies; expanding contingent liabilities; and the ballooning overdue of DISCOMs – warranting strategic corrective measures. As a corrective measure, the State governments must restrict their revenue expenses by cutting down expenditure on non-merit goods in the near term.”